Free Tax Programs 2025 For Senior Citizens. Income tax slab for senior citizens. With this program, eligible taxpayers can prepare and file their federal tax returns using.

22, 2025 — irs free file is now available for the 2025 filing season. Publication 554, tax guide for seniors.

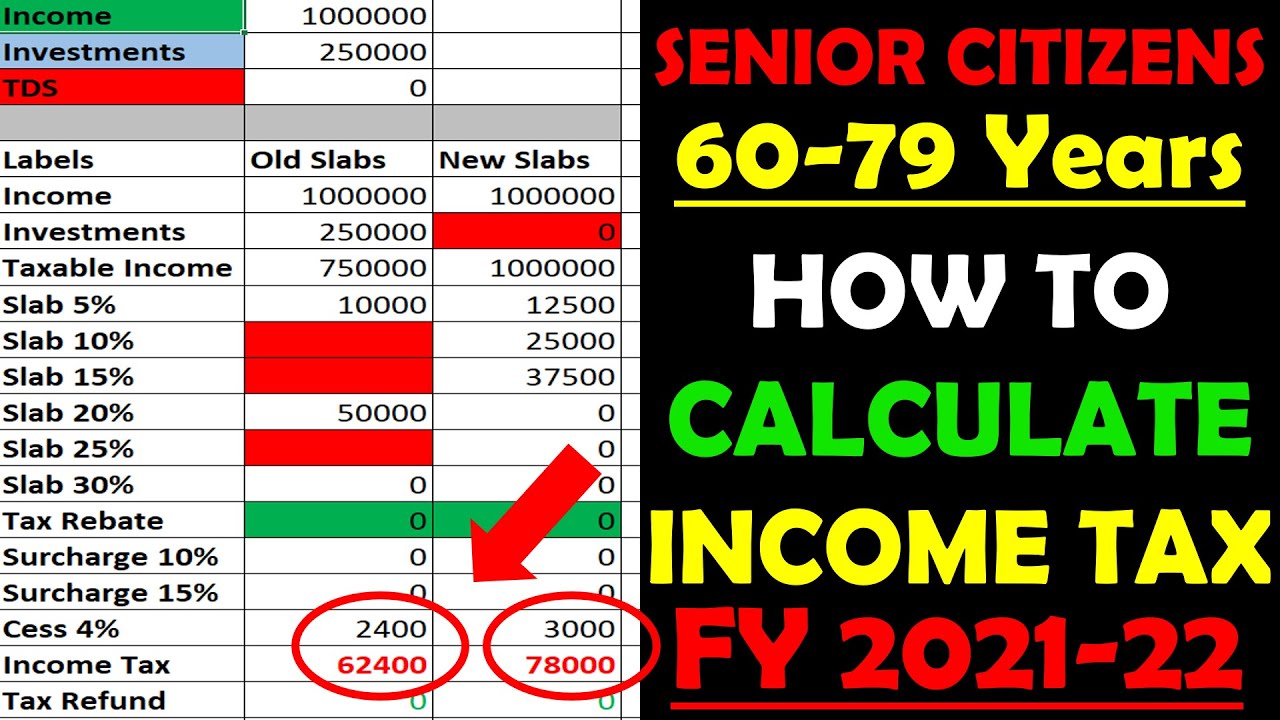

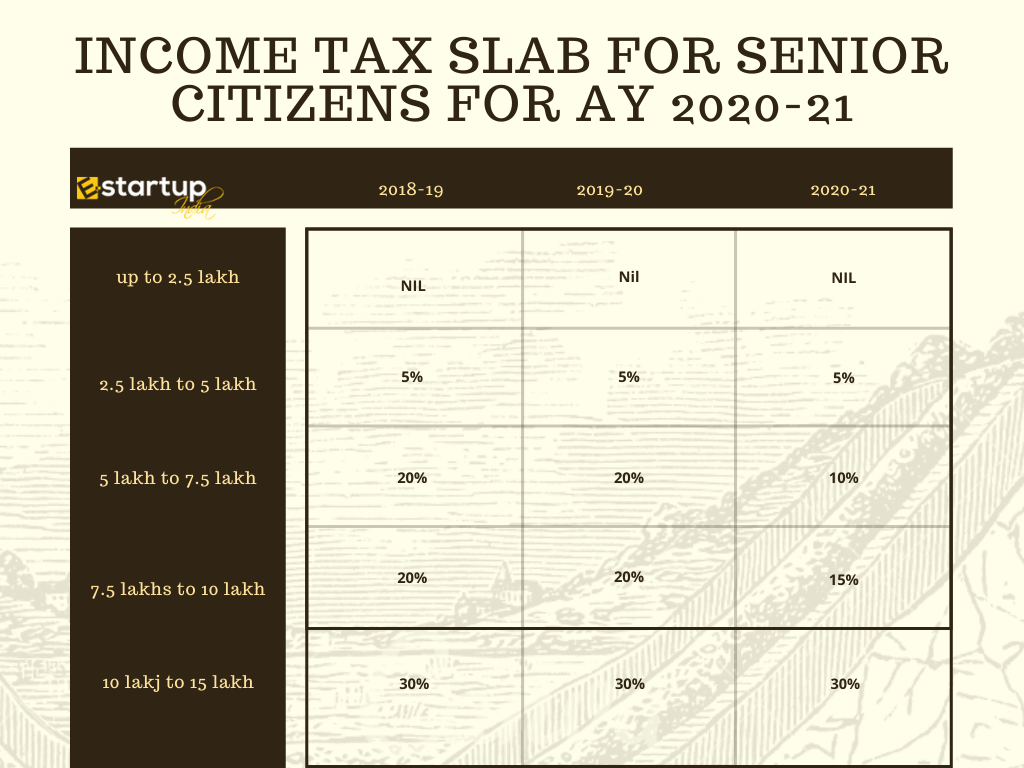

Standard Tax Deduction 2025 For Seniors Andrei Charmion, Income tax slab for senior citizens. Section 194p of the income tax act, 1961 provides conditions.

Senior Citizen Slab Rate Ay 202425 Almira Marcelia, Senior citizens have various ways to save on taxes in the year 2025. Income tax slab for senior citizens.

Free Tax Filing 2025 Low Grace Nellie, Enter your filing status, income, deductions and credits and we will estimate your total taxes. Section 194p of the income tax act, 1961 provides conditions.

Free tax help for seniors YouTube, The program offers online tax preparation software for taxpayers with adjusted gross income (agi) of $79,000 or less in 2025. Tax deductions such as medical expenses, property taxes, and charitable contributions can help seniors maximize their savings and keep more money in their pockets.

Free Tax Assistance Available for Seniors Camden County, NJ, While the government has undertaken numerous vital reforms for the healthcare sector, the industry stakeholders have high expectations. The program offers online tax preparation software for taxpayers with adjusted gross income (agi) of $79,000 or less in 2025.

Free tax help available for seniors from AARP YouTube, The tax counseling for the elderly (tce) program offers free tax help for all taxpayers, particularly those who are 60 years of age and older. Income tax slab for senior citizens.

Tax Benefits for Senior Citizens, Publication 554, tax guide for seniors. With this program, eligible taxpayers can prepare and file their federal tax returns using.

Insight for Caregivers & Seniors Taxes, Special interest to older adults. Section 194p of the income tax act, 1961 provides conditions.

TAX SLAB FY202021 AY2122 FOR SENIOR CITIZEN/SUPER SENIOR, If you require assistance preparing your return, you may qualify to participate in the irs's volunteer income tax assistance. With this program, eligible taxpayers can prepare and file their federal tax returns using.

Tax Tips for Seniors CloudTax Tax Tips YouTube, 24 universities with free tuition for seniors. Many seniors and retirees can file their taxes for free with irs free file, available at irs.gov/freefile.

If you require assistance preparing your return, you may qualify to participate in the irs's volunteer income tax assistance.

Free filing and assistance are available through the volunteer income tax assistance (vita) and tax counseling for the elderly (tce) programs, irs free file.