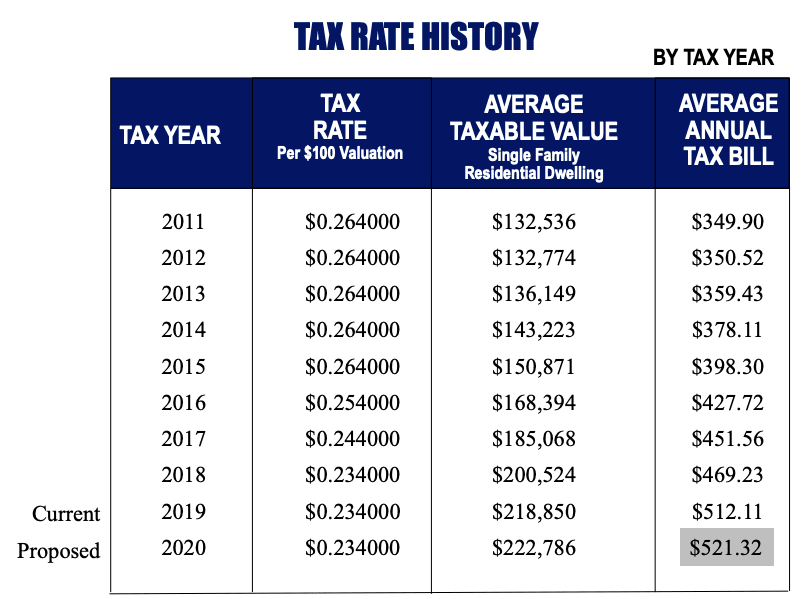

Tarrant County 2025 Property Tax Rate. Tax rates for 2025 have been reported on the department of local government finance’s website, in the county budget orders. Counties in texas collect an average of 1.81% of a property's assesed.

Maintenance of this page is ongoing. Property tax revenue to be raised from new property added to the tax roll this year is $9,940,052. Published august 10, 2025 at 4:18 pm.

Property tax revenue to be raised from new property added to the tax roll this year is $9,940,052. An effort to build about 100 new affordable apartments near northern dallas’ lake highlands neighborhood has cleared a legal hurdle.

Tax rates for 2025 have been reported on the department of local government finance’s website, in the county budget orders.

Tarrant County Tax Assessment Market Value, Tax unit property value exemption net taxable value tax rate tax amount;

Tarrant County Tax Assessment Market Value, By reading this rundown, you’ll get a good understanding of real estate taxes in tarrant.

Tarrant County Tax Assessment Market Value, The new tax rate is 11.217 cents per $100 of valuation.

These States Have the Highest Property Tax Rates TheStreet, Welcome to tarrant county property tax division.

Tarrant County Property Tax Abatement PRORFETY, The median property tax in texas is $2,275.00 per year for a home worth the median value of $125,800.00.

20182024 Form TX TAD 1320 Tarrant County Fill Online, Printable, 2025 tax rates per $100 valuation.

Tax rates for the 2025 year of assessment Just One Lap, All those changes added up to significantly lower property tax bills for many.

Lowest Property Taxes in Texas 5 Counties with Low Tax Rates, The new tax rate is 11.217 cents per $100 of valuation.

Culture map fort worth — in a move to ease the burden on taxpayers, the tarrant county commissioners court has introduced new property tax rates for 2025.